How Much Money Can You Get From Your 401k To Prevent Foreclosure On Primary Home

Partially due to the pandemic, partly due to larger balances, more people are wondering whether they should withdraw funds from a 401k or IRA before retirement to help pay for life. At that place are plenty of reasons to withdraw money from a 401k or IRA early. Unfortunately, some people go too far and cease up using their 401k or IRA like a checking business relationship instead of every bit a retirement business relationship.

Withdrawing funds early from a 401k or IRA is like constantly picking at a scab. The more than y'all do it, the slower your wound volition heal. Pick it also frequently and the wound might really brainstorm to fester and result in a potential amputation (terrible retirement).

Once you starting time withdrawing from your 401k or IRA early to pay for things, you may come to rely on your retirement funds as a crutch. As a result, y'all may never end upwardly building a strong third leg for your retirement stool.

In general, treat your 401k and IRA similar a black hole where coin only goes in and never comes out. Then work to build your after-taxation investment accounts in order to generate passive income.

Of course, if you are facing a life or death situation and the funds in your 401k or IRA are all you have, then withdraw what you need. But expect what happened to stocks in 2020. The S&P 500 airtight up 18% and the NASDAQ closed up 43%. If y'all withdrew funds from your 401k, y'all missed out.

CARES Human activity Changes Withdrawal Rules For 401k And IRA

The rules regarding the withdrawal of funds from a 401k and IRA are somewhat complicated. They are also constantly changing. If you find any errors, please feel costless to permit me know and so I can right them.

Unremarkably, if you lot withdraw coin from a traditional IRA or 401k before reaching age 59 ½, yous have to pay a 10 pct early on withdrawal punishment.

In improver, emergency withdrawals from your electric current employer-provided plans are limited to a gear up of canonical hardships. These may include fugitive foreclosure, home repairs later on a disaster, or medical expenses.

Pandemic Special Rules (Temporary)

However, thanks to the CARES Human action, the 10 percentage early withdrawal penalization was temporarily no more than in 2020 if the pandemic has negatively affected your finances, e.thousand. furloughed, laid off, hours cut, unable to work due to lack of child care, etc.

Ane-tertiary of the money y'all withdraw volition exist counted every bit income in your taxes for each of the next 3 years unless you elect otherwise. The CARES Act also allows you to pay back what yous withdrew from your accounts if you're able to practice then.

But in 2022, the 10% for early on withdrawals from your 401k or IRA will render. Hence, I don't recommend touching your retirement funds unless you admittedly have to.

How Much Can You lot Withdraw From A 401k Or IRA Early?

Before the pandemic, according to the IRS, the maximum corporeality that the retirement plan tin can allow equally a loan is (1) the greater of $x,000 or l% of your vested account balance, or (2) $50,000, whichever is less.

For instance, if you have a 401k residual of $40,000, the maximum amount that you tin borrow from the account is $20,000.

After the CARES Act passed, you lot are at present immune withdrawals of upward to $100,000 per person taken in 2020 to be exempt from the 10 percentage penalty. Yous can't become the special tax and CARES Human action treatments for withdrawn amounts greater than $100,000 in total across all of your accounts. Now that it'due south 2021, there may be new rules. Double check with your auditor.

The CARES Deed also eliminates the 20 percentage automatic withholding that is used every bit an advance payment on the taxes that yous may owe on employer-provided plans like your 401k.

Just know that hardship withdrawals are all the same subject to income taxes. Since your savings went into your retirement plan on a pretax basis, you'll be paying income taxes on the contributions and earnings withdrawn.

You so get a three-twelvemonth period to pay the taxes to the IRS. Nonetheless, if you pay the distribution back within iii years, you tin can file for a refund of the taxes you paid on that distribution.

With Biden equally President, there continues to be pandemic relief of all sorts.

Legitimate Reasons To Withdraw Funds From A 401k Or IRA

Now let'southward go through the most legitimate reasons for withdrawing funds from a 401k or IRA before retirement. (Notation: For withdrawals made during the pandemic, I'm assuming that the principal withdrawal reason is to pay for daily living expenses.) Some of these withdrawals are penalty-free, some are non. Always double check with you lot Hr department.

1) Pedagogy

You are allowed to have an IRA distribution for qualified higher education expenses, such as tuition, books, fees, and supplies. This distribution is all the same subject to income tax, merely at that place is no withdrawal penalty.

For case, if you desire to go an MBA, you can tap your retirement fund for tuition. The rule too allows you to apply this exception for your spouse, children, or their descendants too. Keep in mind this exception is for IRAs only. 401ks or other Qualified Plans are subject to a different ruleset.

Specifically, some 401k plans will permit what is called a "hardship withdrawal," with education expenses sometimes falling under this clause. Expenses eligible for a hardship withdrawal will vary depending on your 401k plan administrator. Therefore, make certain yous enquire first before withdrawing. Some providers do not let hardship withdrawals at all.

Withdrawals from your 401k to pay for didactics are subject to a 10 per centum penalty.

Personal Thoughts

To use your pre-taxation retirement accounts to pay for an overpriced education that is quickly depreciating in value may be a poor financial conclusion.

Instead, I suggest getting extra education function-time during the evenings or weekends. Meliorate still, go your employer to pay. Although it was a PITA for iii years, I'm glad I was able to become my MBA function-fourth dimension betwixt 2003-2006. My employer ended up paying 80% of the tuition, or roughly $70,000 without me losing any career progress.

two) First-Fourth dimension Home Purchase

You lot can take upwards to $x,000 out of your IRA punishment-free for a outset-time dwelling house purchase. If you are married, your spouse can exercise the same for a total of $20,000.

Just like the education exclusion, you lot can also tap this option for the benefit of your family. Your children, parents, or other qualified relatives may receive the aforementioned $10,000 for their purchases. This is even if you've used this benefit for yourself previously or already own a domicile.

There'due south no specific penalisation exemption for offset-fourth dimension home purchases when you pull money out of a 401k. Technically, you lot're making a hardship withdrawal to purchase your offset home. However, it is doubtful buying a showtime home would exist considered a hardship.

Therefore, you are likely to incur a 10 per centum penalty on the corporeality you withdraw from your 401k. To avert the penalty, you meet very stringent rules for an exemption. Even then, you volition still owe income taxes on the corporeality withdrawn.

Personal Thoughts

Withdrawing from your pre-tax retirement accounts to borrow money from a bank in gild to purchase your first home is risky. Such a move could wipe abroad your entire cyberspace worth in a few short years if the existent estate marketplace turns south and you've got to sell. Besides, paying a 10 per centum penalty shouldn't sit down well with you.

Instead, you lot're much better off building your savings and taxable investment portfolio that can provide for a 20% downwards payment. If you lot don't have at to the lowest degree a 20% down payment in greenbacks plus a 10% buffer, y'all probably cannot comfortably afford to buy your first home.

Renting is proficient value now in many big cities. Delight keep your pre-revenue enhancement retirement accounts and your real estate investments separate.

3) Family Circumstances

If you are required by a court to provide funds to a divorced spouse, children, or dependents, the x percentage penalty can be waived.

Personal Thoughts

Contentious divorces happen all the time. We must follow the court rules, otherwise, we may get into bigger trouble. As parents, nosotros should always back up our kids until they become adults. I'g not and so sure the same can be said about ex-spouses.

iv) Medical Expenses Or Insurance

If you lot incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you tin pay for them out of an IRA without incurring a penalisation.

For a 401k withdrawal, if your unreimbursed medical expenses exceed vii.5% of your adjusted gross income for the year, then the penalty will probable exist waived.

Personal Thoughts

In my opinion, a surprise medical expense is the nigh legitimate reason for withdrawing early on from a 401k or an IRA. Nobody goes through life wanting to get a surprise medical expense beyond the cost of what insurance covers.

Medical expenses are often unforeseeable and tin be extraordinarily expensive without sufficient insurance.

Serial of Substantially Equal Payments

If none of the above exceptions match your individual circumstances, you tin consider taking distributions from your IRA or 401k without penalty at any age earlier 59 ½ by taking a 72t early distribution.

The amount of these payments is based on a adding involving your current historic period and the size of your retirement account. Visit the IRS' website for more than details.

The catch is that once y'all kickoff, you have to continue taking the periodic payments for five years, or until you reach age 59 ½, whichever is longer. Too, you volition not be allowed to take more or less than the calculated distribution, even if y'all no longer need the money. So exist conscientious with this 1!

The 401k Loan Is A Better Option

If you have to pay a ten percentage penalty on a withdrawal, so a improve solution is to borrow against your 401k and pay yourself back. A 401k loan does not accept a 10 percent penalization. If your plan allows loans, your employer sets the terms.

Before the CARES Act, the maximum loan corporeality permitted by the IRS was $50,000 or half of your 401k's vested business relationship residue, whichever is less. During the loan, yous pay principal and interest to yourself at a couple points above the prime rate, which comes out of your paycheck on an afterwards-tax basis.

Under the CARES Deed, y'all can now borrow up to $100,000 of your 401(k) balance, with upward to six years to pay yourself dorsum for the loan. In this scenario, you do non accumulate whatsoever tax liability. And as y'all pay back the loan, those amounts get reinvested faster than if y'all delay paying the tax liability on a distribution. The interest rate for a 401k loan is mostly betwixt two.five% – 6.five%.

Just remember that the CARES Act pertains simply to 2020 and so far. I presume the rules will revert to the way they were pre-CARES in 2021 and across.

Borrowing from your 401k is a good alternative considering you do not need a credit check, naught appears on your credit report, and interest is paid to yous instead of a banking concern or credit card visitor.

But once again, if you habitually borrow from your 401k, you'll likely never be able to salve plenty in your 401k for retirement.

Motivation To Non Withdraw Funds From A 401k

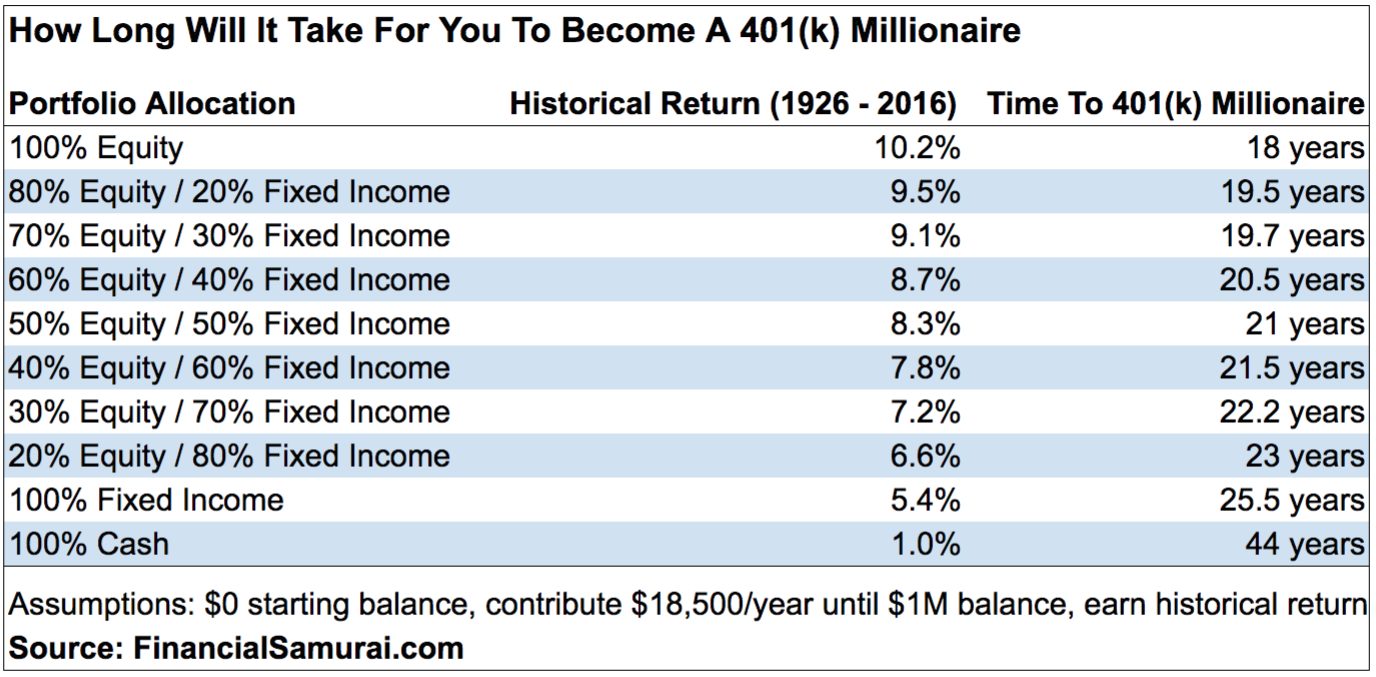

Every time you're tempted to infringe from your 401k, take a await at this chart below. Information technology shows you when y'all will become a 401k millionaire based on various portfolio allocations and return assumptions.

Not only is paying a ten percentage punishment painful for a hardship withdrawal, and then is losing out on years of compounding.

IRA Rollover Bridge Loan

There is one terminal way to "infringe" from your 401k or IRA on a brusk-term basis: roll it over into a different IRA. Y'all are allowed to do this once in a 12-month period. When you roll an account over, the coin is not due in the new retirement account for threescore days. During that period, you can practise whatsoever you desire with the cash.

All the same, if the entire amount is non safely deposited in an IRA when the fourth dimension is upward, the IRS will consider it an early distribution and you lot will be subject to penalties on the full amount.

This is a risky move and is not mostly recommended. But if you want an involvement-free bridge loan and are sure you can pay it back, it's an option.

Withdraw Money From Dissimilar Accounts First

Given 401k and IRA contributions are pre-taxation contributions, from the regime'southward point of view it makes sense there should be penalties assessed for early withdrawals.

The IRS doesn't like that y'all haven't paid taxes on your contributions and received the benefits of taxation-costless compounding, even so still want to withdraw funds for some random expense you don't demand.

The better practice is to become through the post-obit succession of fund pilfering:

- Savings

- Later on-tax investments

- Side job income

- Borrow money interest-gratuitous from a friend or family unit member

- Cajole your parents into giving you lot some of your inheritance today

- Take out a personal loan with an interest rate under 10%

- Roth IRA

- 401k or IRA

With the Roth IRA, since y'all've already paid taxes on your contributions, you tin withdraw contributions you fabricated to your Roth IRA anytime, taxation- and penalty-free. Nevertheless, you may take to pay taxes and penalties on earnings in your Roth IRA if you've held for less than five years.

After you've held the account for 5 years, you can withdraw up to $10,000 in earnings without penalty or tax for the purchase, repair, or remodel of a first home. In other words, you lot can withdraw all of your contributions plus another $10,000 from earnings and not pay the 10% punishment or taxes on any of it.

There is i caveat, however: you lot only have 120 days to spend the withdrawal or you may be liable for paying the ten% penalisation. Too, for your convenience, your fiscal services firm should be able to automatically prioritize the withdrawal of all of your contributions from a Roth IRA earlier any earnings.

Try Not To Impact Your 401k Or IRA

Information technology may be tempting to withdraw funds from a 401k or IRA to pay for a automobile or a fancy vacation. If you do, nonetheless, y'all're only pain your retirement. It's much better to pay for superfluous things through other sources.

Hopefully, yous never reach the point where you take to consider withdrawing funds early from a 401k or IRA for a necessity, fifty-fifty without a x percent punishment.

Continuously build your financial buffers. The more than you have, the more protected your 401k or IRA will be. When yous finally retire, you volition exist happy that you left your funds untouched all those years.

Build More Passive Income Through Real Estate

One way to prevent yourself from withdrawing funds from a 401k or IRA is by developing perpetual passive income streams. One of the best ways to generate passive income is through existent estate. By the time I was 30, I had bought two properties in San Francisco and one holding in Lake Tahoe. These backdrop now generate a meaning corporeality of by and large passive income.

In 2016, I started diversifying into heartland real manor to take reward of lower valuations and higher cap rates. I did and so by investing $810,000 with existent estate crowdfunding platforms. With interest rates down, the value of greenbacks flow is upwardly. Farther, the pandemic has made working from home more mutual.

Take a await at my 2 favorite existent estate crowdfunding platforms. Both are gratuitous to sign up and explore.

Fundrise: A mode for accredited and not-accredited investors to diversify into real estate through private eFunds. Fundrise has been around since 2012 and has consistently generated steady returns, no thing what the stock marketplace is doing. For most people, investing in a diversified eREIT is the way to go.

CrowdStreet: A way for accredited investors to invest in private existent estate opportunities mostly in xviii-60 minutes cities. 18-hour cities are secondary cities with lower valuations, higher rental yields, and potentially college growth due to chore growth and demographic trends. If you have a lot more capital, y'all can build yous own diversified existent estate portfolio.

Recommendation To Improve Manage Your 401k

Manage your 401k meliorate with Personal Capital, a free financial tool. I've used Personal Uppercase since 2012 and take seen my 401k skyrocket.

With Personal Capital, you tin can analyze you lot 401k for excessive fees. Personal Capital'south Investment Checkup tool also analyzes your asset allocation and provides rebalancing recommendations.

Farther, Personal Capital letter has a fantastic Retirement Planner tool to assist you program for your retirement future.

Explanations From Real People Why The Median 401k Balance Is So Low

Summit 401k Mistakes People Make That Rob Them Of Thousands

How To Reduce Your 401k Portfolio Fees

Source: https://www.financialsamurai.com/reasons-to-withdraw-from-a-401k-or-ira/

Posted by: riosbroment.blogspot.com

0 Response to "How Much Money Can You Get From Your 401k To Prevent Foreclosure On Primary Home"

Post a Comment